(Before you start, know this – the article is LONG, and probably quite dull if you’re not interested in the business side of the club, or worried about its long-term strategy.)

—

On 27 January 2011, John Henry and Tom Werner penned a lengthy reply to Spirit Of Shankly that came about as close as anything has to outlining their intentions relating to the club.

You can find the letter HERE.

Sidestepping the political and arguably PR-driven subtext of the letter, there was a clear structure to the rhetoric – enough, in fact, to found a little retrospective assessment – the kind that maybe we ought to be doing on a regular (and forensic) basis given our not too distant encounter with shiny men from far flung lands promising us this, that and the other. If we’re suspicious, it’s not borne of innate disrespect – it’s more a case of ‘best practice’.

So – to the task in hand.

—

THE 4 PILLARS OF THE FSG APPROACH

I. “TRANSPARENCY”

From their own words in the letter, after appealing to readers not to be judged by their predecessor’s financial misdemeanours, Henry and Werner refer to Bill Shankly, the Liverpool way, and ‘transparency’.

Rather than living in the past and with an accountant’s abacus, we have made it a point since our ownership began to try to understand the core underpinnings – ethos – of what made LFC great. Clearly, the spirit of one man, Bill Shankly, carried the Club on his shoulders into the first division and then to trophies driven by his burning desire to win – to do whatever it took to win, and in winning, determined to do it the right way — the Liverpool way.

In the spirit of Mr. Shankly, the questions supporters should consider today include: where do we go from here as a club, as owners and as supporters. What is ownership going to do after taking on this huge responsibility? What are supporters going to do? What must the club do? These are the important questions and that’s where we need transparency. What are our proper roles, responsibilities and actions that must be taken on in this quest to return LFC to the spirit of Bill Shankly?

So – to the sub-clauses.

- We were assured transparency re what ownership were going to do.

- We were asked for transparency re what we as supporters were going to do.

- We were assured transparency re what the club ‘must’ do.

Transparency on ‘our proper roles, responsibilities and actions’.

It’s all a bit vague, but we can just about get the gist of it. I think from the fans’ perspective, the club and the owners have been given all the cooperation and transparency they could have wanted, save for a few borderline sectioning-cases on Twitter.

What’s abundantly clear from the letter is that Henry and Werner were intent on ‘managing the noise’ as Hicks so gracefully put it.

“You do bring up the issue of season ticket availability and stadium issues. These are important issues and ones that we want to have a larger and longer dialogue on. But we don’t want to have that dialogue with only one group of LFC supporters. We hope you can understand that.

This is one of several debates that could potentially swallow the overall assessment whole, and as such, it’s maybe best skirted over for now, but the point has to be made for the assessment to be credible.

It’s still early days for the Committee, and as such, it’s hard to assess how effective it is. The owners talk of ‘regular, high level dialogue’. That equates to ‘OK, we’ll listen to you, and we’ll do it pretty regularly, but let’s not get into the detail’. We all have our own views as to whether that’s right; but we shouldn’t let it stand in the way of independent scrutiny.

From the owners themselves, a big part of me prefers dull opacity rather than the kind of transparency they’re talking about anyway. It only invites articles like this, after all. And for me (again, this is just my personal view) we’ve had a mixed bag on this front. We’ve inevitably had no shortage of rumour, some of it scurrilous, some not, and we’ve had an indication that the owners ‘expect a top four finish’ – that anything lower would be a disappointment.

We’ve also seen vague rationalisation for Andy Carroll’s purchase, and for Fernando Torres’s sale, and of course the infamous bigging up of Aquilani and Ngog.

@John_W_Henry

One missing link last year: Acquilani. Put the ball near Ngog and the goal and it’s going in. Too much talk of them somewhere else.

Of course, both players were soon to be ‘off the books’. Cue the inevitable speculation and bemusement from many in the support, and the surrounding media.

For the club’s part, we now have twin spokesmen in Kenny Dalglish and Damien Commolli. The roles of the two men at times seem a little incongruent. On the one hand, we have Kenny Dalglish trying to re-establish an alpha male relationship with the assembled media pack of the kind enjoyed by Alex Ferguson at Manchester United. He tends to play a straight bat at every opportunity, revealing as little as possible, while portraying as convincing a picture of unity at the club as he can – insisting that ‘things will always be done behind closed doors’. The post-match chat after the Wolves away game was seen as a high watermark in the club’s relationship with the media by most fans.

On the other hand, Commolli quite often reveals snippets of strategic plans and the like.

Nothing instrinsically wrong with either of course, apart from the broader context – but the two don’t seem congruent. And that in itself is far from transparent. It makes you want to peer in and see if you can see something naughty happening.

From my perspective, I find myself wanting them to screw the nut and integrate things properly. More on that below. But at the same time, while citing the need for transparency, it was interesting to see them sidestep the specific question of just how much they paid to buy the club. Thus far we’ve had to rely on the media to help on that front, so as always, we await the annual accounts and hope for clear evidence of a sound financial footing.

—

II. COMMERCIAL AGGRESSIVENESS AND BRAND BUILDING

Back to our letter, then.

Henry and Werner set out the competitive and environmental constraints facing the club, and acknowledge that given our disadvantages, we need to be commercially aggressive and capitalise on a worldwide supporter base – this in order to be a ‘Big Four Club’ or ‘Top Four Club’. They then justify the notion of ‘brand’ in support of that pursuit of increased revenue, with reference to unity of purpose behind a common goal: winning the league.

There are of course those who object to this ‘aggressively commercial’ approach, but short of a completely different model of ownership in football, most would concede that this is a necessary evil, so long as any notion of brand is rooted in the club’s community, and that it both sustains and remains predominately sustained by that immediate community, while remaining inclusive to new fans and ‘eyeballs’. A brand is, of course, about what’s uniquely special in a product. The club embodies its community and the people who’ve grown and sustained it and vice versa over the generations.

So honestly, how do they seem to be faring on this front?

Again, we look forward to the annual results, and until that point we can only really rely on media reports and club statements. It’s been interesting to note that Swiss Ramble, the now established go-to media expert on matters football finance, has received lavish praise from John Henry himself online.

The Swiss Rambler published his latest LFC-related analysis in May. Henry, on reading the article, tweeted as follows.

@John_W_Henry

@SwissRamble Consistently remarkable, excellent analyses on the business of football. swissramble.blogspot.com

The article had this to say of Liverpool’s likely future strategy.

It is entirely appropriate that we concentrate on the new owners’ future strategy, not least because John W Henry made his fortune as a futures trader.

Actually, I say “fortune”, but everything’s relative. While his estimated worth of £375 million might be enormously impressive to the proverbial man in the street, it’s small change compared to the billions owned by other prominent owners of football clubs, such as Sheikh Mansour, Roman Abramovich, Stan Kroenke and even the Glazers. It’s actually even lower than the likes of Peter Coates at Stoke City and David Sullivan at West Ham.

Therefore, Liverpool fans should not expect a classic sugar daddy. Instead they have got a group of savvy businessmen with proven expertise and a superlative record in sports management. Nevertheless, the new owners will still need to access substantial funds in order to strengthen the squad and address the stadium situation (either build a new stadium or redevelop Anfield), so the obvious question is how will this be financed? Liverpool fans would not want to see the club take on large levels of debt once again, so Henry’s team really has to address the club’s faltering business model.

Although we are not privy to their strategic plan, we can make some fairly good guesses at where they will try to turn around Liverpool’s finances, based on their announcements to date, which I have attempted to summarise in a 15-point plan.

To summarise that point in short form:

- Shirt sponsorship with Warrior

- Be aggressive commercially on a global basis

- PL place – just stay in it – doesn’t affect income much outside top 4 slots

- Get Champions League qualification – you’re talking £30m plus, easily

- Global digital TV rights – explore ways to exploit them

- Manage down wage bill – from ‘a huge payroll for a squad with little depth’ to value for money

- Avoid managerial severance payouts and aim at continuity

- Manage contract accounting to best effect (player amortisation, asset value, contract value – the next set of accounts are likely to show high profits on player sales from 1st couple of FSG-owned transfer windows)

- Use financial muscle to complement value purchases, but spend big on the right players

- Build on the Academy and Reserve setup

- Either build or redevelop to break the stadium impasse

- Increased ticket prices at the ground

- Naming rights for the resulting stadium

- Restrict debt to stadium-related funding

- Exploit FFP

*Aside – the list possibly misses Tom Werner’s point that FSG look to “leverage the collective power and appeal of… brands to drive revenues”, meaning there’s scope to work with the other entities either owned by or affiliated with FSG to build their collective value.*

On point 14, Swiss Ramble makes a very important point.

The really good news is that Henry has confirmed that the change in ownership has removed all the debt except for £37 million for development work on the proposed new stadium, which is part of a £92 million credit facility agreed with RBS. Normal working capital requirements mean that £87 million of this had been used by 31 January this year.

This is enormously significant to the club’s finances, as the prohibitively expensive annual interest payments of £40 million have been drastically reduced to just £3 million, which means that Liverpool are “able to invest more in the team rather than servicing debt” according to Ian Ayre.

Of course, debt could substantially rise again for future stadium developments, but Henry does not appear overly concerned, “I think fans will understand that stadium debt is different from acquisition debt.”

Point 14 is of course the one we’re most precious about, and it naturally relates directly to the transparency ‘pillar’, I think we’d all agree. We’ll all be keeping an eye on the accounts – it’s now hard wired into our collective psyche.

There’s no indication that they’ll depart from that model – we hope not at least. But some fans will need to bite down hard on what that approach means in terms of short-term investment in the first team squad. We’ll see investment, but commensurate with revenue and profit growth.

Of course, we should never complain about that – our growth needs to be steady and sustainable, and many of our rivals aren’t in a position to make even that level of investment (thank God).

None of us should need reminding to be careful what we wish for.

So we might reasonably expect strategic choices that grow revenue with FFP firmly in mind. Henry tweeted again shortly after his initial praise for Swiss Ramble as follows.

@John_W_Henry

@VinayJ7 The big question is whether FFPR will be enforced. If they are it’s about being smart. If not it’s a race to lose the most money.

Then, five days later, he tweeted in praise of Arsene Wenger’s criticism of the Etihad Campus deal, and it’s apparent contravention of FFP.

@John_W_Henry

A club’s best player has to be worth at least 10% of your naming rights. http://www.guardian.co.uk/football/2011/jul/12/arsenal-manchester-city-premier-league Mr. Wenger says boldly what everyone thinks

So you might conclude that Henry has FFP on his mind. So given his ongoing admiration of Swiss Ramble, it’s maybe worth reading these two articles, both of which delve a little deeper into their situation, and shed light on the Etihad Campus approach.

Manchester City’s Incredible Deal

His look at their overall progress and strategy

It seems it’s not such a contravention after all, when you dig a little deeper. So where does that leave us in competitive terms? In a ‘race to lose the most money’? Do we just shrug our shoulders and accept that in strategic and competitive terms, we’re snookered? Or is there scope for FSG to do comparable in L4? What would that mean for FSG, and for the club? Who knows.

The stadium issue is a classic dillemma, but ultimately they’ll have to go with an option and commit to it. But that said, it’s a delicate issue, and one round which FSG will have to tread carefully. To say people are impatient for progress is an understatement.

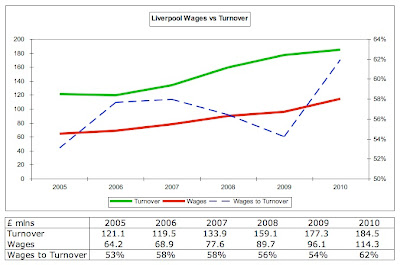

On the revenue and profit-related front, Swiss Ramble neatly summarised Liverpool’s annual results from 2005 on in the following images. (Apologies for reproducing them out of context here – they’re intended to illustrate the points made, but I can’t emphasise enough that you should read the original article if you haven’t already done so.)

The picture portrayed was of robust revenue growth, stalled to some extent following the club’s departure from the Champions League places, and likely to be stalled yet further with the departure from European competition altogether. That said, the club had continued to squander money on CL-tailored player contracts, and was suffering from a sharp spike in wages as a percentage of turnover – a metric that’s particularly significant interms of UEFA’s Financial Fair Play rules.

What that signalled was a worrying decline in the value its playing squad’s wage bill was generating – something other clubs (most notably Tottenham) were significantly outperforming us on.

Swiss Ramble commented as follows.

“On completing due diligence, John W Henry said that Liverpool’s wage bill was one of “a number of unpleasant shocks. Specifically, he thought that it was a huge payroll for a squad with little depth. It stands to reason that the £114 million wage bill should be reduced, especially when you consider that it is so much higher than Tottenham’s £67 million. That does not imply a “slash and burn” approach, more a case of the club getting better value for money, as Henry explained, “We have to be more efficient. When we spend a dollar, it has to be wisely. We cannot afford player contracts that do not make long-term sense.”

It’s likely to be with this in mind that John Henry praised Damien Commolli’s efforts in the summer 2011 transfer window. That window set a firmer foundation in terms of the wages to turnover ratio.

On The Tomkins Times in June 2011, Dan Kennett explained how this might be achieved in an article that should be required reading for all Reds – “Fair Play For Fenway”.

He neatly summarised his points in the following diagram, circling in red the players whose contracts might feasibly come up for review by the new owners.

What jumps out at you is that the article was pretty prescient. In short, if your name’s in that red zone, there have to be pretty compelling reasons to keep hold of you at the club. There’s nothing to indicate the club will depart from that approach in the near future, and that has to be seen as one of the big successes of FSG’s tenure to date. We now get far more value from our playing staff.

Rory Smith at the end of the summer reported that “An astounding £30 million has been wiped from the wage chitty, and a little over £20 million raised in funds.”

At the same time, the new additions to the squad would tend to fall safely outside the ‘red zone’ in Dan Kennett’s revised version of the ‘player contract value’ graph, and that sets a firm foundation for the club to build on. We might have our reservations on the merits of certain players, but in financial terms, we’re better placed than we were.

There is, of course, some debate over whether our approach to transfer negotiations has been ideal, with haggling over value, only to end up paying the initial asking price anyway (running the risk of losing the player in the interim). There are maybe areas FSG could review and refine; however, in terms of salaries, we’re doing better.

That focus, combined with the ongoing development of the youth and reserve setup, and with clear evidence of strides being made commercially, bodes well for a self-sufficient model in the medium term (media-led catastrophes aside).

One point to note – the club is currently looking to replace Commercial Director Graham Bartlett, who left the club having been in place for less than a year. What does that mean for Ian Ayre? Does it mean a new CEO is coming in? Who knows – but it’s one worth keeping an eye on.

Also worth noting, of course, is that no purchases were made in January when arguably there was a pressing need for it. Kenny portrayed a united front of course, often in the face of rampant media speculation (which the media would no doubt often claim is well founded from other sources).

—

III. THE “4 SIDES OF THE SQUARE”

Returning to the letter, FSG go on to update Shankly’s ‘Holy Trinity’, citing the following as ‘the 4 sides of the square’:

1. The manager and ‘football operation’

The wording here is reassuring, and you can only hope it’s borne out in reality. FSG state clearly that they want the right long-term manager, and the best football operation in the world. The by-products of both being in place are of course mentioned, namely stability, a unified footballing philosophy, and selflessness staff whose own interests are secondary to the LFC cause.

It’s a can of worms – it always is, particularly in this day and age – but it’s clear progress has been made in this regard. You hope the owners learn how to nurture and sustain progress in this regard – media statements and talk of expectations for the season only increase speculation around a manager. And of course, a lack of support for the football operation when off-field matters spiral out of control can have a big impact on results.

FSG came to the club with a reputation for clever strategic thinking, and an ability to embed management best practice where none previously existed. You might say they’ve proven there’s work still to do at Liverpool FC, without getting into the deeper debate (and let’s not do that here please). You’d hope they’re hard at work tweaking the roles of those involved where they’re talented but struggling with individual aspects, putting processes in place to deal with unexpected environmental challenges, or simply hiring the right people around the key men themselves to provide the support they need. Time will tell – it’ll demonstrate how serious they are about this aspect – and it’s surely the key aspect.

2. The players

The wording here talks of players who feel a responsibility to the club and its supporters, and who see it as a privilege to wear the shirt.

Again, debate on this front is a can of worms, but you’d hope this criterion is central to our scouting and selection. It’s impossible to argue with it really, and it’s good to have seen it acknowledged at the top level.

3. The owners

The wording’s impossible to challenge really – the owners must want to win, must never be satisfied with second best, and must provide the resources to enable the football operation to meet those expectations.

Flowing from that, an important point: “Finally, it is up to ownership to ensure that the atmosphere of the club is permeated by a desire from everyone to be on the same page. Everyone.”

It’s clear that everyone associated with the club is frustrated with how things have gone in the league; however, the club has already won its first trophy in several years since they took the reins, and as such, we can only hope they look to build steadily on that success.

4. The supporters

While it’s an issue for many, it’s also maybe an inevitability that Henry and Werner word this ‘side’ as they do. They talk of supporters more in terms of their financial contribution than in terms of their devotion. Of course, the club must boost its sponsorship, advertising and merchandising revenues if it’s going to remain competitive; but the club will change in the process – sadly it’s inevitable. You can only hope it retains its understanding of what makes the club unique, and its supporters and community remain the most irreplaceable part of that. Nurture and develop that foundation, and you’ll reap the long-term rewards. It can’t be recreated. Just ask Roman Abramovich.

—

IV. ALIGNED GOALS – INVESTMENT RETURNS, AND ON-FIELD SUCCESS

In retrospect, looking at Henry and Werner’s phrase that ‘Ownership has committed revenues to building the club’ – the accounts will maybe tell us more, but despite media reports to the contrary, that means a club run within its means – not one that’s seen a huge capital injection from new-found ‘sugar daddy’ owners. It’s been odd that FSG have benefited from that kind of comment, but such is the nature of our football media at times. They have a hard enough time grappling with the concept of ‘net spend’ – we maybe shouldn’t expect much sophistication from them on the finance front.

Surely we all hope to see evidence that confirms the following.

Ownership has committed revenues to building the club – not to dividends and not to profits. If there are profits someday – then so be it. But they must come as a result of having built the strongest club in the Premier League and for no other reason. Our manifesto should resonate with that of the supporters. We have exactly the same goal. We want the greatest football club in history – nothing less. And we are going to do exactly that. But we will not be successful – as supporters, as owners, as players or as an organisation – if we are not all on the same page. All of us.

That’s sensible in the long-term, and while it maybe hints at meagre pickings in the summer transfer market, most intelligent Reds would prefer a more focussed recruitment approach from this point on. Quality, not quantity, and on terms that reinforce progress in the football operation, rather than disrupt it.

—

Conclusion

Of course, the only conclusion you can draw right now is that it’s not really possible to draw any meaningful conclusions. We’ve seen evidence of good things under their ownership, and we’ve seen things that maybe we’re not so keen on. And, this being Liverpool Football Club, there’s no shortage of rumours on all fronts, from the stadium, to the proposed new Warrior kit design, to who the likely new signings will be come the summer. All we can do is keep our eyes on the radar, and do our best to ensure that if the owners fail to live up to their own billing, that they’re held to account through our ongoing forensic scrutiny.

Needless to say we await the annual accounts with bated breath (well, enough of us do anyway). For now, though, it comes down to our gut feelings really. How do you guys think FSG are faring so far?

Great read roy but for now I remain on the less than impressed side. Another 18 mths and the key to our long term revenue generation (more seats at our ground – new or old) remains as up in the air as ever. If they deliver a build or redevelop then finally we will have taken our first real giant leap forward.

Great article and a very interesting read, or though this quote,

“We have to be more efficient. When we spend a dollar, it has to be wisely. We cannot afford player contracts that do not make long-term sense.”

Would surely mean the owners questioning Kenny’s wisdom in buying Carroll for 35 million pounds on a long term contract, and then hardly playing him because he is clearly not good enough, and then 6 months later compounding that mistake by doing the same again and signing Downing. If I was FSG I’d have some serious questions about the way he spent their money.

With regards to carroll i think it was comolli who signed him, and its not just me using any excuse to defend kenny as i think suarez was also commolli’s work. My reasoning is that i doubt FSG would’ve given Dalglish so much money to spend when he was still in a caretaker role, and had only had this role for 2-3 weeks. I think the summer transfers were a joint effort with commolli’s role basically being a scout with authority.

Well said Roy. I think so much trust was lost in the H&G era that it’s made sceptics of us all with regards to the intentions of FSG. It’s kind of like learning to love again after your bird cheats on you, it’s easy to believe that the next one will do exactly the same thing. Inevitably I think we’re all gonna have to have a little faith, and looking at parts of this season, a good deal of patience an’ all. That said I find it comforting to know that dedicated, educated fans such as yourself are still keeping a watchful eye on those in power. Cheers.

I feel a certain amount in debted to them for getting us out of a terrible situation. They wiped our debts and it seems like it is in their best interest to make us grow in a stable manner. They are savvy, and I have a certain amount of trust in them.

What I will say is that in baseball, top players get between $20-25mil a year in salary. FSG know what it is like to pay for quality. They wont mind spending £100k a week if it is deserved. They gap between salaries may be added into our transfer policy. Red Sox player payroll 2011 est. $141mil with 2 players earning over $20mil a season and 4 more earning over $10mil a season. Baseball does bring in a hell of a lot of money though, a lot more games than the PL.

I don’t know enough about business models and marketing to know much more. I jut come from a fans perspective. They saved our club and for that, I’ll always be grateful.

I think taking everything into account, they’ve done a good job. Let’s not forget where the club was 18 months ago… It was always going to be a long and hard rebuild. They are going to make mistakes like any human- don’t forget they’ve never owned a football club before- but right now they are giving us a foundation to build on. Here’s hoping for a new stadium ASAP!

As if on cue from Ian Ayre: http://www.liverpoolecho.co.uk/liverpool-news/local-news/2012/03/16/liverpool-fc-and-everton-fc-chiefs-ian-ayre-and-robert-elstone-reveal-thoughts-on-future-of-both-clubs-100252-30548720/

[quote]

[Everton’s Robert] Elstone ruled out redeveloping Goodison Park as unaffordable and Mr Ayre said the Reds were looking for a responsible way to add 20,000 extra seats to their gate receipt. Everton is currently searching for a new home and Liverpool is mulling over whether to build a new ground in Stanley Park or redevelop Anfield.

…Ian Ayre believes Anfield represents one of the best stadium atmospheres.

“People are more interested in what happens on the pitch. It’s not to say that the other things are not important.

“It is about finding the right solution that keep the great heritage experience and atmosphere and finding the right thing for the future. It’s not so easy a challenge.

“We have to have the right economic model.

“Our sweet spot is around 60,000 to 65,000, because we don’t want empty seats.

“We already have 46,000 seats, and those extra 20,000 seats are not going to generate hundreds of millions.

“If it meant we were writing cheques for that rather than the team people will ask why.

“We have got to do it in a responsible way. If you don’t do that you can get yourselves in all kinds of trouble.

“The board are very focused on it but conscious of the fact it has to be the right economic model.”

Robert Elstone said: “I agree with what Ian said, the most important thing is the atmosphere and the experience, so maybe we have got the recipe for a share.

“Chelsea FC recently did some work about the challenge of redeveloping and staying at Stamford Bridge, and it said their capacity would go down.”

He said the London club had been told it would be hugely complex and also cost £600m.

“There are similar problems to rebuilding Goodison.

“The only sensible option is land acquisition. I genuinely believe that the redevelopment of Goodison is not a realistic option.”

He said ideas to redevelop the Park End would still leave the other three sides of the stadium in desperate need of updating.

“We have to look for a new site and use the Kirkby funding model which involved 40% to 45% of the capital cost coming from retail uplift subsidy.

“I don’t think there are a shortage of sites, I believe there is a shortage of funding.

“I think our optimum capacity is around 50,000, which generates an extra £5m [a year]. That means its tight, it needs a great naming rights deal or subsidy, or probably both.”

[/quote]

To say that article’s interesting is an understatement.

Well-in Roy, though submitting this probably melted the server. Brilliantly detailed and analysed.

The key as to whether FSG are successful here is the issue of the stadium. As they appear unwilling to inject their own funds, we are reliant on generating our own.

After Waldorf and Statler, there is a healthy reluctance to fully embrace the owners. Some were all too quick to get behind H+G initially, and thankfully this has not been repeated.

They haven’t came in and revolutionised the club. They will live or die on the issue of the stadium.

Thanks for the considered replies by the way guys. One point worth underlining after Ayre’s comments yesterday is that for every thousand seats you add, the cost per seat of the overall development trends up and up and up, if not exponentially, then very steeply indeed.

After going through all that surely we deserve an honorary degree ! But thanks for the article, together with all the links and indeed the links from the links its a great resource which I’m sure I’ll be coming back to again and again.

In short I think its still too early to tell with FSG, but the signs are good.

The first thing that strikes me is that the letter is a salutary reminder of the awful mess we were in fans, players management and especially owners. It is impossible to underestimate this or the fans concern when you read betwen the lines of the letter. In those simple terms I think everybody would agree we have made great progress.

The second thing is understanding the purpose and objectives of FSG’s purchase. We may moan about how far behind we are behind our global rivals, but the letter seems to summarise a more complex thinking that underlines that FSG bought us BECAUSE we are a club with immense unrealised potential and are determined to realise it.

From the supporting links the basic way to grasp this is through the areas of Matchday Media and Commercial. To take one example on the Commercial side Bayern Munich make 140m to our 60m. We are clearly starting to make progress with the shirt deals etc but there is much more that could be done.

On the flip side the delay on progress to the future of the stadium is now also understandable. It is very expensive, takes years to develop and build incurring debt during and after and as with all construction projects is comparatively risky – not to mention fixing a legendary Venue that aint broke. God knows what the break even date would be but I think a decade as an order of magnitude would not be an exaggeration. It is important for the long term future but we really do need to focus on Media and Commercial where there are specific non-risk returns of vast potential to be made NOW. Once we are seriously on track with the Commercial and Media then we can start thinking about taking the plunge with the stadium.

Finally after trawling through that lot our player buys seem to make considerably more sense. Really our understanding on this topic – I mean the media and the fans – is clearly too simplistic – for example has anybody read anything about ‘amortised’ costs in the mainstream press ?! It is not only a financial game however – if so for one thing you’d be selling Gerrard for Carrol !

Many fans may be baying for instant success through a Sugar daddy and a team of Anelkas but the strategy seems to be to manage and grow our way to success on and off the pitch and this means time. Love it or loathe in this financial climate its probably the only way anyway – n.b. Ayre at the Global Entreprenuers Congress. Personally I love it – it means the risk of sudden death through debt fractures or perpetual turmoil through player or even managenent churn is much reduced. And it puts clear water between us and clubs like Chelski – this is LFC after all.